Opening Range Break-out

_SECTION_BEGIN("OPENING RANGE BREAK-OUT");

uptrend=PDI()>MDI()AND Signal()<MACD();

downtrend=MDI()>PDI()AND Signal()>MACD();

Plot( 2, "ribbon",

IIf( uptrend, colorGreen, IIf( downtrend, colorRed, 0 )),

styleOwnScale|styleArea|styleNoLabel, -0.5, 100 );

_SECTION_END();

SetChartOptions(0,chartShowDates|chartShowArrows|chartLogarithmic|chartWrapTitle);

_SECTION_BEGIN("POS SIZE");

cap = Param("Capital", 0,100000, 5000000, 50000 );

risk = Param("Max. Risk",0.0025, 0.005, 0.02, 0.0025 );

_SECTION_END();

_SECTION_BEGIN("Volume");

Plot( Volume, "Volume", ParamColor("Color", colorLightGrey), styleNoTitle | ParamStyle( "Style", styleHistogram | styleOwnScale | styleThick | styleNoLabel, maskHistogram ), 5 );

_SECTION_END();

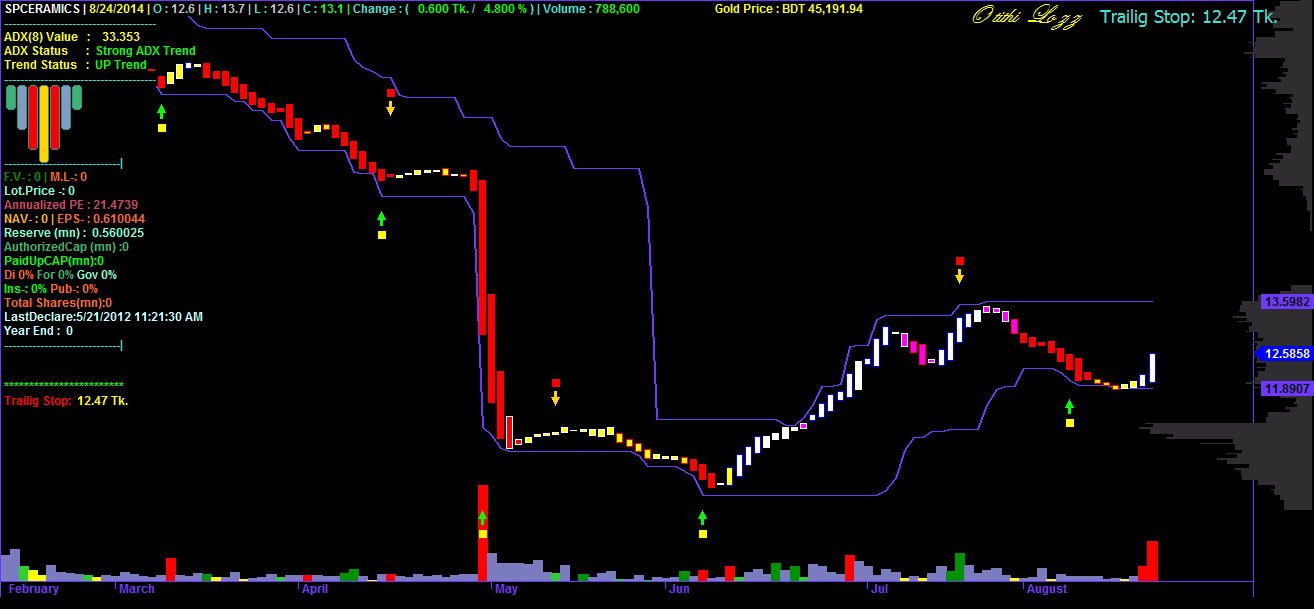

TrailStop = HHV( C - 2 * ATR(10), 15 );

Plot( TrailStop, "Trailing stop", colorCustom11, 8);

GfxSetOverlayMode(0);

GfxSelectFont("Tahoma", Status("pxheight")/15 );

GfxSetTextAlign( 6 );

GfxSetTextColor( ColorRGB( 200, 200, 200 ) );

GfxSetBkMode(3);

GfxTextOut( FullName(), Status("pxwidth")/2, Status("pxheight")/4 );

_SECTION_BEGIN("ORB");

tn = TimeNum();

dn = DateNum();

u = ValueWhen( tn<093000, HighestSince(dn!=Ref(dn,-1), H ));

w = ValueWhen( tn<093000, LowestSince(dn!=Ref(dn,-1), L ));

a= EMA(Close,5)-(EMA(ATR(1),10)*1.50) ;

b= EMA(Close,5)+(EMA(ATR(1),10)*1.50) ;

a1=(u-a)*RoundLotSize;

a2=((u-w))*RoundLotSize;

b1=(b-w)*RoundLotSize;

b2=((u-w))*RoundLotSize;

Longtgt=u+(u-w);

Shrttgt=w-(u-w);

//Plot(u,"Hgh", ParamColor("HighColor", colorRed), styleNoLine|styleDots);

//Plot(w,"low",ParamColor("HighLow", colorBlue),styleNoLine|styleDots);

//Plot(Longtgt,"",colorGreen,styleNoLine|styleDots);

//Plot(Shrttgt,"",colorGreen,styleNoLine|styleDots);

_SECTION_BEGIN("ORB POS SIZE");

cap1 = Param("Capital", 0,100000, 5000000, 50000 );

risk1 = Param("Max. Risk",0.0025, 0.005, 0.02, 0.0025 );

_SECTION_END();

_SECTION_BEGIN("GMMA");

a=C;

g=(EMA(Close,3) * (2 / 4 - 1)-EMA(Close,60) * (2 / 61 - 1)) / (2 /4- 2 /61);

e=Ref(g,-1);

Plot (EMA(a,3), "3ema", colorBlue,styleNoLabel);

Plot (EMA(a,5), "5ema", colorBlue,styleNoLabel);

Plot (EMA(a,8), "8ema", colorBlue,styleNoLabel);

Plot (EMA(a,10), "10ema", colorBlue,styleNoLabel);

Plot (EMA(a,12), "12ema", colorBlue,styleNoLabel);

Plot (EMA(a,15), "15ema", colorBlue);

Plot (EMA(a,30), "30ema", colorRed,styleNoLabel);

Plot (EMA(a,35), "35ema", colorRed,styleNoLabel);

Plot (EMA(a,40), "40ema", colorRed,styleNoLabel);

Plot (EMA(a,45), "45ema", colorRed,styleNoLabel);

Plot (EMA(a,50), "50ema", colorRed,styleNoLabel);

Plot (EMA(a,55), "55ema", colorRed,styleNoLabel);

Plot (EMA(a,60), "60ema", colorRed);

Plot(C,"close", colorBlack,styleCandle);

Cond1=StochK(14)>StochD(14);

Cond2=StochK(14)<StochD(14);

Buy=Cross(C, u);

Sell=Cross( w,C);

Filter = Buy OR Sell;

_SECTION_END();

AddColumn( IIf( Buy, 66, 83 ), "Signal", formatChar );

AddColumn(Close,"Close",1.2);

AddColumn(Volume,"Volume",1.0);

Cond13=PDI()>MDI();

_SECTION_END();

_SECTION_END();

Title = Date()+" "+ Interval(format=2)+" "+Name()+" "+"O "+WriteVal(O)+" "+"H "+WriteVal(H)+" L"+WriteVal(L)+" C "+WriteVal(C)+EncodeColor(colorRed)+" Lot Size "+WriteVal(RoundLotSize,1.0)+" Margin"+WriteVal(MarginDeposit,1.0)+

"\n"+EncodeColor(colorBlack)+"ORB TRADE"+"\n"+EncodeColor(colorGreen)+" Buy above "+WriteVal(u,1.2)+" Target "+ WriteVal(Longtgt,1.2)+"\n"+EncodeColor(colorRed)+" Sell below "+WriteVal(w,1.2)+" target "+ WriteVal(Shrttgt,1.2)+

"\n"+EncodeColor(colorBlue)+" Trade risk based on ORB Rs "+ WriteVal((u-w),1.2)+ " Position Size based on " + WriteVal(risk1*100,1.2)+ " % risk = " + WriteVal((cap1*risk1)/(u-w),1.0)+ "shares"+"\n"+ EncodeColor(colorGreen)+" ADX is "+ WriteIf(Cond13,"BULLISH","BEARISH ");

_SECTION_BEGIN("my FIST");

tn = TimeNum();

dn = DateNum();

u = ValueWhen( tn<093000, HighestSince(dn!=Ref(dn,-1), H ));

w = ValueWhen( tn<093000, LowestSince(dn!=Ref(dn,-1), L ));

Buy=Cross(C,u) ;

Sell=Cross(w,C);

shape = Buy * shapeUpArrow + Sell * shapeDownArrow;

PlotShapes( shape, IIf( Buy, colorBlue, colorRed ),0, IIf( Buy, Low, High ) );

GraphXSpace = 5;

dist = 5*ATR(10);

for( i = 0; i < BarCount; i++ )

{

if( Buy[i] ) PlotText( "ORBuy\n@" + u[ i ], i, L[ i ]-dist[i], colorBlue

);

if( Sell[i] ) PlotText( "ORSell\n@" + w[ i ], i, H[ i ]+dist[i],

colorBlue);

}

Plot( 1, "", IIf(EMA(C,15)>EMA(C,60) , colorPaleGreen, colorRose ),styleArea | styleOwnScale, 0, 1 );

_SECTION_END();